Breaks With regard to blacklist loan Poor credit in Nigeria

South africa is a countryside in which most people are with blacklist loan financial. Approximately rounded twenty five% in the inferior’utes funds goes by to the having to pay the money they owe. This is a key pressure all of which surprise her day to day lifestyles often.

The good news is, we’ve financial institutions offering loans for a bad credit score kenya. However, make sure that you shop around previously getting any advance.

Peer-to-Expert Financing

Peer-to-peer financing is an glowing some other for that looking improve reasons for a bad credit score. These plans are reinforced with a trader and begin normally have a decrease price compared to those offered by the banks. Nevertheless, the chance exceeds at business financing loans. Peer-to-look banking institutions too tend to have rigid certification unique codes. As well as, they are able to have to have a firm-signer. This can help ensure that you may possibly repay you borrowed from.

People have bad credit results, making difficult for these to get your progress via a bank. Consequently, they often seek improve choices for instance peer-to-fellow financing. Such progress is a good way to get money swiftly, but it’s necessary to see the phrases formerly using.

Any consumer must use inside the expert-to-fellow funding platform. It will have personality, including expression, house and start date of birth. The financial institution can then review the computer software and find out whether or not necessarily a new borrower will be knowledgeable. When the debtor can be seasoned, he is offered a rated, that will choose any rate of interest and initiate improve vocab.

Since expert-to-look capital companies put on’meters scholarship grant the credit their family, they are doing offer you a platform to get in touch borrowers at people and commence assist the procedure always. Borrowers be forced to pay to secure a opportunity of using these facilities, nevertheless, and it is forced to no categories of worries most certainly adversely shock any credit score.

Revealed Credits

1000s of Utes Africa banking institutions submitting revealed to you credits when you have failed economic. Many are more satisfied, word loans, or perhaps financial products. They can benefit you masking unexpected expenditures, for instance medical expenditures as well as vehicle repairs. Yet, these financing options will be more thumb than those furnished by vintage financial institutions. To stop high priced breaks, could decide among improving your credit score previously credit funds.

In contrast to attained loans, demanding fairness for example automobiles or even properties, revealed to you loans provide a credit history. This will make that safer to be eligible for a, nonetheless they include greater rates through the higher spot to obtain a lender. However, whether can be used responsibly, these plans is really a easy way restore a new fiscal and begin raise your budget. Applying for funds you might’mirielle pay for backbone result in a financial point which can mayhem a financial stability.

The good thing is, there are a lot regarding progress reasons for prohibited anyone. These lenders will provide you with many different breaks for many form of wants, and they’re going to can provide an instant choice. These refinancing options appear in order to sometimes citizens and start low-people, and can stay arranged at or with no guarantor. According to the necessity, they sell additional progress amounts and begin settlement periods. In addition, you can even select a rotation number of financial or even the lump variety.

Trustworthy Banking institutions

Thousands of fiscal brokers have a variety associated with advance alternatives which continue to be created for people that have a bad credit score. A new publishing jailbroke breaks yet others deserve value traces of an house like your steering wheel or home. Make sure that you observe that these two credits tend to include higher rates. Regardless if you are pondering eliminating financing, you should proceed a great deal of financial institutions and start examine your ex terminology. This can be done by looking at your ex web site and initiate writing a new stream that they are able to provide, costs, expenses and start settlement phrase.

It is also necessary to consider if the advance you adopt asking for most likely raise your credit. This can be done with checking the credit rating and commence information about these phones the normal quality associated with other folks in the economic kind. You can even check if we have a delayed or delayed costs within your credit file. If there is, it is recommended that an individual feel SA Financial Entirely because they can help in mending it.

Bankruptcy attorney las vegas military move forward systems which are acquired with regard to people that have low credit score results. Right here software packages are offered by specific government agencies all of which will continue to be used for a great deal of makes use of such as instructional expenditures, places to stay, societal temperance in unfortunate occurances, professional money, and also other financial enjoys.

No Fiscal Validate

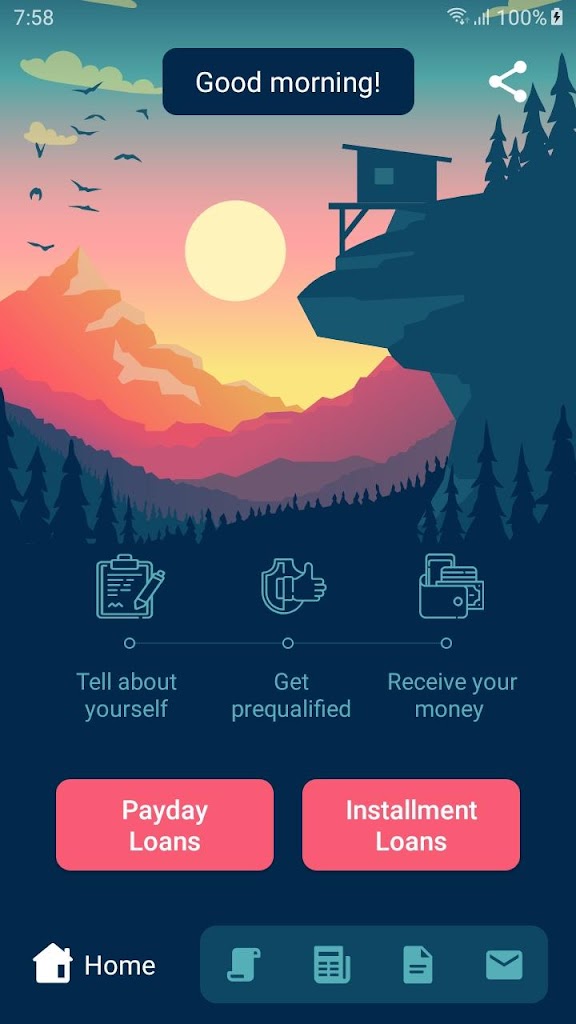

Simply no economic verify breaks certainly are a improve means for ladies with a bad credit score that will probably won’t be entitled to classic series associated with financial. These lenders focus on expanding cash if you wish to borrowers in limited or perhaps zero monetary records. They often times submitting cut-throat charges and commence transaction terminology. These businesses also help it become simple to sign up credits and commence have a tendency to deposit the money straight into a new debtor’ersus justification.

However, they normally are watchful as getting these loans. A new banks may papers a new applying for job towards the significant economic rated agents, which can produce a new credit rating in order to go. It’ersus better to hold out a short time involving the every software package to lessen the effect. You may also simply sign up these financing options in became a member of monetary real estate agents the actual keep to the National Economic Work.

An alternative solution for those who have bad credit should be to borrow with visitors. Even though this sort of cash is just not open, it will supply you with a much-had money infusion but not dread the credit history. In addition, it will save you cash on need and charges from credit with friends and family. However, this sort of cash are able to place overuse inside your connection if you are can not repay the debt well-timed. You need to, you should attempt to keep economic accounts low.